Your Guide to Money Market Funds: A Simple Way to Grow Your Money in 2025

Your Guide to Money Market Funds: A Simple Way to Grow Your Money in 2025

Let’s Talk About Money Market Funds

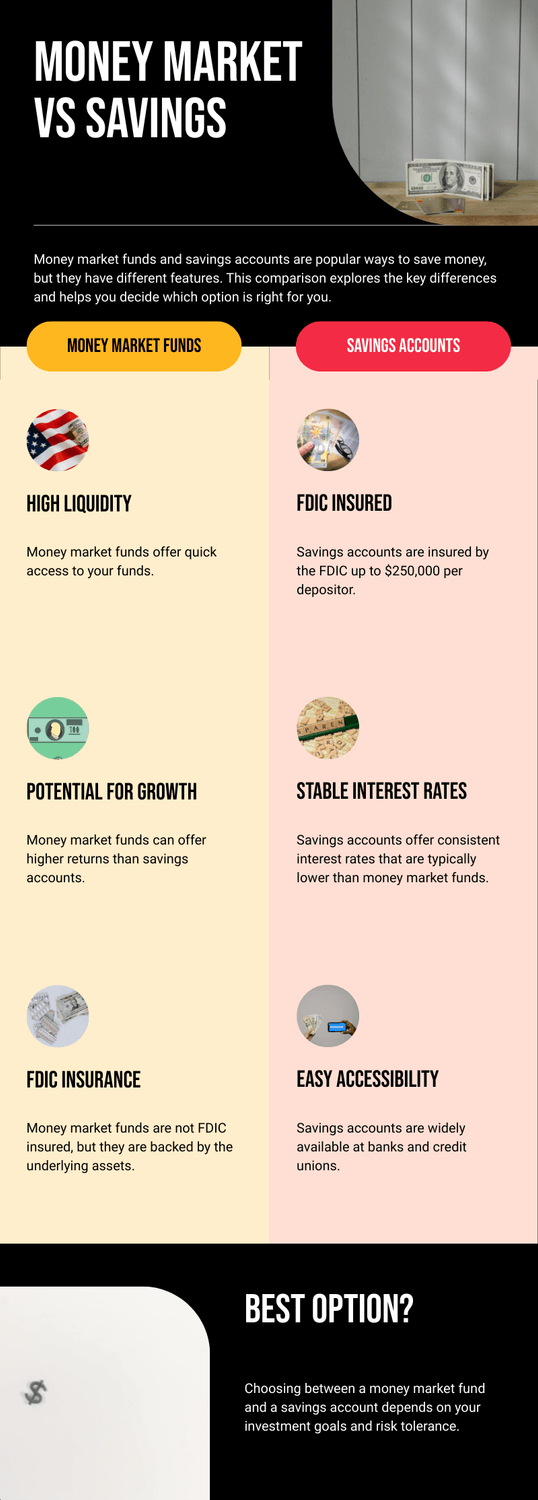

If you’re looking for a safe and easy way to grow your money, you’ve come to the right place. Money Market Funds (MMFs) might sound fancy, but they’re actually one of the simplest ways to make your money work for you.

Think of them like a savings account—but smarter.

What Exactly Are Money Market Funds?

Money Market Funds are low-risk investments where your money goes into things like Treasury bills, CDs (certificates of deposit), or short-term loans for businesses. Basically, it’s a way to grow your money without the stress of wild ups and downs like in the stock market.

Why Should You Care About Money Market Funds?

Here’s why they’re worth considering:

1. They’re Safe. You’re not gambling your money here. MMFs stick to low-risk investments.

2. You Can Get Your Money Fast. Need cash for an emergency? No problem. MMFs are super liquid, which means you can pull out your money quickly.

3. They Earn More Than Savings Accounts. While you won’t get rich, MMFs typically offer better returns than regular savings accounts.

Types of Money Market Funds

Not all MMFs are the same, so let’s break it down:

Government Funds These invest in U.S. Treasury securities. They’re the safest choice.

Prime Funds These go into corporate debt, which gives you slightly higher returns but a bit more risk.

Tax-Exempt Funds These focus on municipal securities, meaning the interest you earn might not be taxed.

Who Should Use Money Market Funds?

Money Market Funds are perfect for you if:

You want a better place for your emergency fund.

You’re saving for a short-term goal, like a vacation or new car.

You’re risk-averse and don’t want to dive into stocks.

How to Choose the Right Money Market Fund

Picking the right MMF isn’t hard. Just ask yourself:

What’s Your Goal? Do you want safety, higher returns, or tax savings?

What Are the Fees? Look for funds with low expense ratios.

Who’s Managing It? Stick with reputable companies like Vanguard or Fidelity.

How to Start with Money Market Funds

Pick a Trusted Broker or Fund Company. Popular choices include Vanguard, Charles Schwab, or Fidelity.

Decide How Much to Invest. Many MMFs let you start with $1,000 or less.

Watch Your Money Grow. Dividends are paid out regularly, and you can reinvest them for more growth.

A Few Myths About Money Market Funds

“They’re just savings accounts.” Nope. MMFs are professionally managed and earn better returns.

“They’re completely risk-free.” While very safe, they aren’t insured like bank accounts.

“You need a lot of money to invest.” Actually, many funds have low minimums.

Potential Risks to Keep in Mind

No investment is 100% perfect, and that includes MMFs. Here’s what you should know:

They’re Not FDIC-Insured. While rare, there’s a tiny chance of loss.

Inflation Risk. If inflation is high, your MMF might not keep up.

Interest Rate Risk. When rates go up, MMF returns can drop.

Top Money Market Funds for 2025

Want some recommendations? Here are a few to check out:

1. Vanguard Federal Money Market Fund (VMFXX)

Safe and reliable, with low fees.

2. Fidelity Government Money Market Fund (SPAXX)

Great for daily liquidity and consistent returns.

3. Schwab Value Advantage Money Fund (SWVXX)

Competitive yields with easy access to your money.

FAQs About Money Market Funds

1. Can I lose money in a Money Market Fund?

It’s rare, but technically possible in extreme cases.

2. Are MMFs a good option for emergency savings?

Yes! They’re safe and easy to access.

3. How do I get started? Pick a fund, invest, and let it grow—it’s that simple.

Why Money Market Funds Might Be Perfect for You

If you’re looking for a low-risk, easy way to grow your money, Money Market Funds are worth a shot.

They’re simple, safe, and a great tool for building financial stability in 2025. Why not give your cash a chance to work a little harder?

Don't miss out on my next blog post (and more!)

Sign up for my newsletter!

Name

The content provided in this blog post is for informational and educational purposes only. It does not constitute financial, investment, tax, or legal advice. Please consult a licensed professional for advice tailored to your individual situation. The author and www.jelfritorres.com are not responsible for any decisions or actions taken based on this content.