The Best Personal Finance Software in 2025 to Take Control of Your Money

The Best Personal Finance Software in 2025 to Take Control of Your Money

Why You Need Personal Finance Software in 2025

In 2025, staying on top of your money is more important than ever. Why? Because the financial landscape is changing.

Groceries, utilities, and subscriptions are eating up bigger chunks of our budgets, and without a plan, it’s easy to feel like you’re sinking.

The right personal finance software helps you:

Understand where your money is going.

Create realistic savings goals.

Make smarter financial decisions.

What Makes a Great Personal Finance Tool?

Not all tools are created equal, and finding the right one depends on your goals. Here’s what you should look for:

1. User-Friendly Design

Choose software that’s simple to use, even if you’re not a tech expert.

2. Customizable Features

Your finances are unique, and your tool should reflect that. Look for features like tailored budgeting and goal tracking.

3. Bank and Investment Syncing

Integration with your accounts ensures you get a complete picture of your financial health.

Top Personal Finance Software for 2025

1. Mint: The Beginner-Friendly Budgeting Tool

Mint has been a go-to for years—and for good reason. It’s free, intuitive, and packed with features to help you track every dollar.

Why You’ll Love It: Mint simplifies budgeting with automatic expense tracking and spending alerts.

Best Features: Real-time updates on your spending habits. Goal-setting tools to keep you motivated. Alerts for subscription charges you might’ve forgotten about.

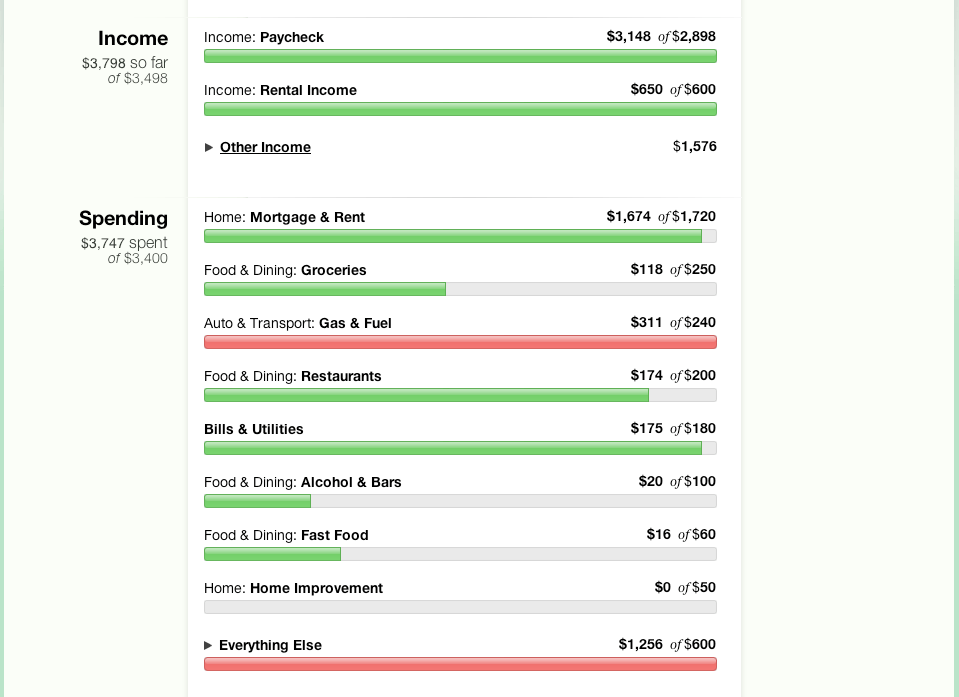

image source: https://yourpfpro.com/the-most-powerful-budgeting-tool-around/

2. YNAB (You Need a Budget): For Detailed Budgeters

If you’re serious about taking control of your money, YNAB is a game-changer. Its zero-based budgeting method forces you to assign every dollar a job, so nothing goes to waste.

Why You’ll Love It: YNAB helps you think ahead, making it easier to handle emergencies and big expenses.

Best Features: Real-time syncing across devices. Visual reports to show where your money is going and educational tools to improve your financial literacy.

image source: https://www.pcworld.com/article/407658/ynab-review-you-need-a-budget.html

3. Personal Capital: The Wealth Builder’s Tool

If you’re focused on growing your wealth and planning for retirement, Personal Capital offers a mix of budgeting and investment tracking tools.

Why You’ll Love It: It combines everyday money management with serious investment insights.

Best Features:Net worth tracking in real time. A retirement planner to map out your future and an A fee analyzer to identify where you’re losing money in investment fees.

image source: https://robberger.com/empower-review/

4. Honeydue: Perfect for Couples

Managing money as a couple can be tricky, but Honeydue makes it simple. Whether you share accounts or prefer to keep things separate, this app keeps everyone in the loop.

Why You’ll Love It: It helps you avoid financial surprises and communicate better about money.

Best Features: Shared expense tracking for joint goals. Notifications for upcoming bills. Options to track individual and joint spending.

5. QuickBooks Self-Employed: The Freelancer’s Favorite

Freelancers and gig workers, this one’s for you. QuickBooks Self-Employed makes it easy to track income, organize expenses, and prepare for tax season.

Why You’ll Love It: Say goodbye to tax-time stress with features designed specifically for independent workers.

Best Features:Automatic mileage tracking for deductions. Tools for estimating quarterly taxes. Seamless integration with TurboTax.

How to Choose the Right Software for You

Here’s a quick guide to picking the best tool for your needs:

What’s Your Goal? Are you trying to budget better, invest smarter, or manage shared finances?

What’s Your Budget? Some tools are free, while others charge a subscription fee.

What Features Matter Most? Focus on tools that align with your priorities, whether it’s automation, reporting, or customization.

Getting the Most Out of Your Personal Finance Software

Here’s how to make sure your tool works for you:

Explore All the Features: Many apps offer advanced tools you might not notice at first, like subscription tracking or savings insights.

Set Realistic Goals: Whether it’s saving for a vacation or paying off debt, start with manageable steps.

Check In Regularly: Consistency is key. Review your finances weekly to stay on track.

Final Thoughts

Personal finance software isn’t just about crunching numbers—it’s about giving you control and confidence. With the right tool, you can save more, spend smarter, and finally achieve the goals that matter most to you.

So, which one are you trying first? Let me know how it works for you—I’d love to hear your success stories!

Don't miss out on my next blog post (and more!)

Sign up for my newsletter!

Name

The content provided in this blog post is for informational and educational purposes only. It does not constitute financial, investment, tax, or legal advice. Please consult a licensed professional for advice tailored to your individual situation. The author and www.jelfritorres.com are not responsible for any decisions or actions taken based on this content.